Pet-industry entrepreneurs find millennials’ disposable income a gold mine | Financial Post

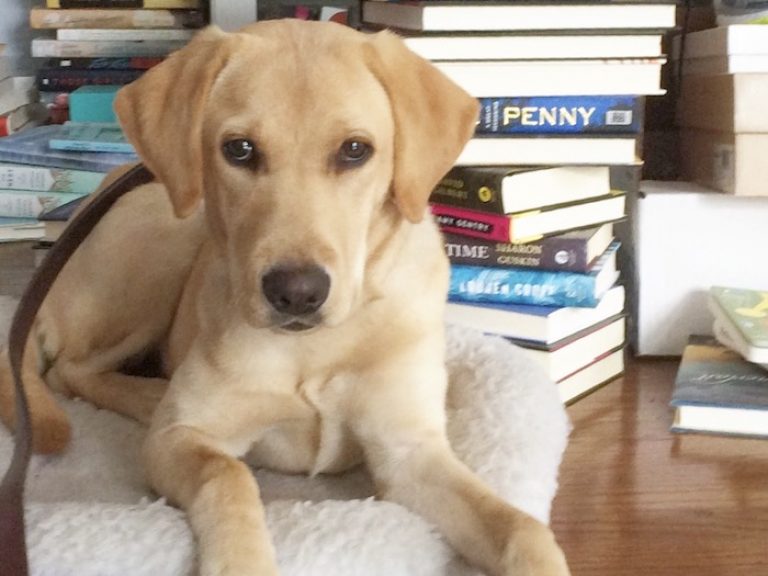

When Emma Harris welcomed her new yellow lab puppy, Bo, into her home in 2016, little did she realize he would become the inspiration for starting her own business.

Harris has long been interested in supporting entrepreneurship through her studies and working with various startups in finance, sales and marketing roles.

But when Bo came onto the scene, “I quickly found out he had lungworm. Dealing with that was so stressful because I was always travelling on my job and the vet clinic was always closed by dinnertime. Every time I had a question I had to book an appointment.”

Telemedicine seemed to be a practical solution. But her research showed that vets were not allowed to practice medicine by any form of digital interaction. In 2017, however, a policy statement was issued that allowed vets to serve consumers digitally.

At that point, Harris was armed and ready with her plan for Healthy Pets, a subscription-based digital platform for veterinary consultations that costs a mere fraction of a clinic visit.

Last year, her pitch on Dragons’ Den got the attention of Arlene Dickinson, who subsequently invested $500,000 through her District Ventures Capital VC fund. Up to that point, Harris says she had taken out a $30,000 line of credit and funded her business through pitch competitions.

Healthy Pets has since signed on 30 clinics in Ontario with more coming on board at a steady pace. In homage to the company’s roots, the now-healthy Bo has been given the honorary title of Chief Inspiration Officer.

“What they are trying to do with telemedicine in the pet space is cutting edge and definitely addresses a need in our industry,” says Brendon Laing, veterinarian at the Town & Country Animal Hospital in Stouffville and co-founder of Furiendly, a mobile vet clinic. “It’s a place where veterinarians can triage patients without the owner having to take time off work, to travel or pay for parking.”

The pet industry represents a gold mine of opportunity on a number of fronts, Harris says. “Spending on pets is astronomical. In North America, owners spend US$90 billion a year, and the number is growing by eight per cent each year.”

According to Packaged Facts, the Canadian pet industry is worth around $7 billion including food, supplies and services. “About 65 per cent of Canadian households own at least one pet,” Harris adds.

Not only that, they are humanizing their pets more than ever before, which opens the doors to a wealth of business opportunities.

Laing says the pet industry’s growth can be attributed to the major demographic shift from Baby Boomers to millennials. “Basically millennials use them as starter kids. They’re pet parents, not pet owners. In fact, millennials spend more on their pets on average, even though statistics show they don’t have as much discretionary income as Baby Boomers. Many will take a job (where) they can bring their dogs to work, even it’s less pay. They’re more willing to spend money for a pet costume than they spend on themselves. It’s a big shift that I think is great.”

Willson Cross is further down the entrepreneurial path with his company, GoFetch Technologies Inc. The 25-year-old Vancouver-based entrepreneur co-founded the company in 2015, which last year received $3.4 million in a third round of funding.

GoFetch.ca builds on the marketplace model used by the likes of Uber and Airbnb to create an online community where pet owners can connect with dog walkers, sitters and boarders in their area. He says marketplaces like GoFetch.ca succeed largely through having a network effect. “Once you have that going, you can disrupt the industry. It’s such a slim-margin game, you need massive volume. The greater the volume, the more valuable the marketplace becomes.”

Acquisition interest in innovative pet ideas is a telling sign of how hot the market is, he adds. SoftBank Vision Fund recently invested $300 million in Wag!, the U.S.-based on-demand dog walking and dog-care app. PetSmart bought the Chewy.com ecommerce site for US$3.35 billion in April 2017. “That was the largest ecommerce acquisition ever,” Cross notes. (PetSmart has since spun off a 20-per-cent stake to BC Partners, a private equity firm.) And in mid-June, Cross announced that GoFetch had been acquired for an undisclosed sum by Future Pet Animal Health.)

Pet care is definitely an industry in which an entrepreneur can thrive with the right formula, Cross adds. “Food delivery, home services, transportation and hospitality (have been disrupted). Now we’re seeing it in pets. In an age where we’re seeing a lot of millennials owning pets instead of having children, the timing makes perfect sense.”

Original Source: https://business.financialpost.com/entrepreneur/0703-biz-dd-pets-fpe

Publishing Information: 03 Jul, 2018 By Denise Deveau